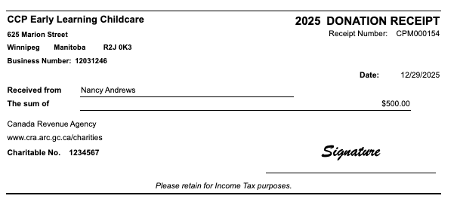

The user can now generate a donation receipt for charitable donations through the reports left menu item.

To access:

- Reports > Accounting > Receipting > Donations

To print or save:

- Click the PDF icon

View Style: Donations Receipt

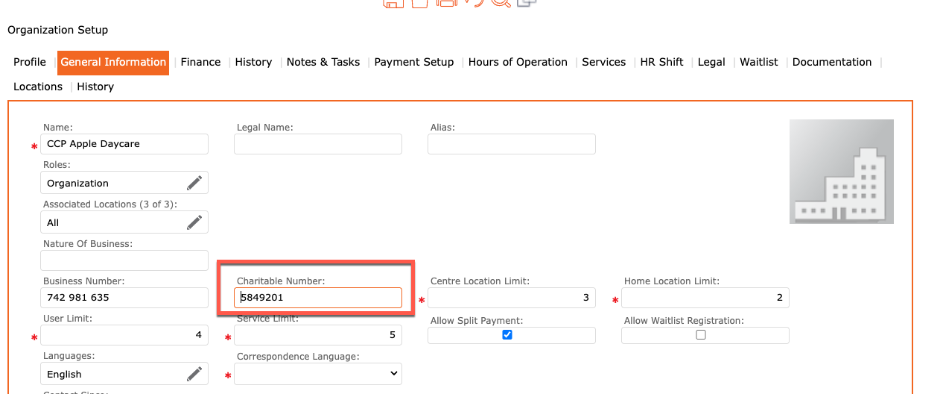

Organization Setup – Charitable Number

Description: The user can now add a Charitable Number to the Organization Setup. This MUST be set up to generate a Donation Receipt.

To add a charitable number:

- Go to the left menu > Setup > Organization > General Information

- Charitable Number = Enter the Organization Charitable Registered Number

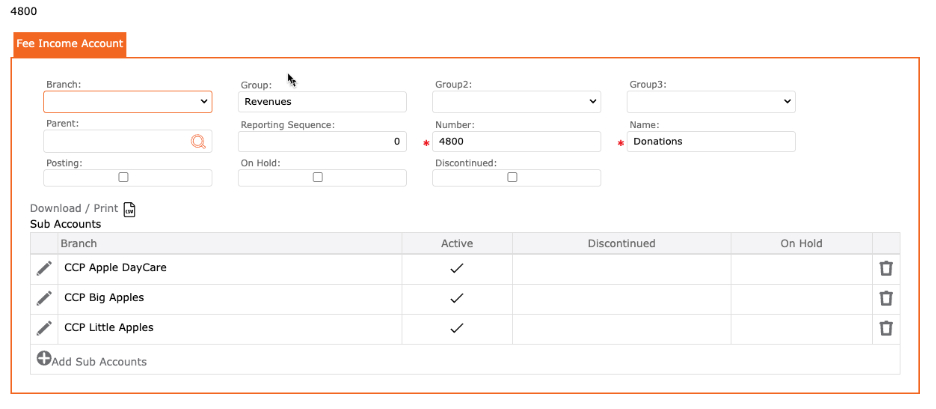

Setup > GL Account for Donations

Description: The user can now add a GL Account for Donations. This must be set up to generate a Donation Receipt

- Go to Setup > Accounting > Fee Income > Create a new Fee Income Account

- Enter the Account Number

- Enter the Account Name (example: Donations)

- Click SAVE

- Then, de-select the Posting checkmark

- Add the sub accounts

- Click the checkmark to apply

- Click the SAVE icon to save all

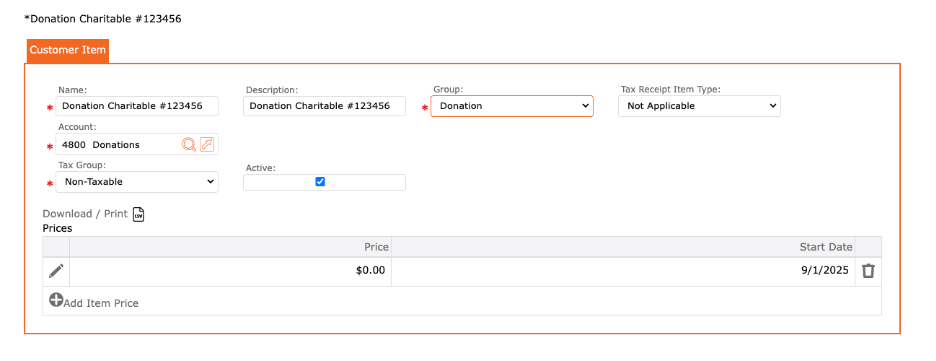

Setup > Item for Donations

Description: The user can now add an item for Donations. This must be set up to generate a Donation Receipt

- Go to setup > Accounting > Fee Item

- Click Create New

- Name = Donations

- Description = Donations + Organization Charitable Number

- Group = Donation (IMPORTANT for proper receipting)

- Tax Receipt Item = Not Applicable

- Account = Associate to the Donation GL Account

- Tax Group = Non-Taxable

- Active = YES

- Prices:

- Click the “+ Add Item Price”

- Price = $0.00 or any amount (this can be overridden when creating a manual invoice/ payment)

- Start Date = When does this price take into effect

- End Date = Applicable end date, or 9999

- Click the checkmark to apply

- Click the SAVE icon to save all

Processing a donation in CCP MAX

Description: To process a donation in CCP MAX, the user must first invoice the payer and then apply a payment to this invoice.

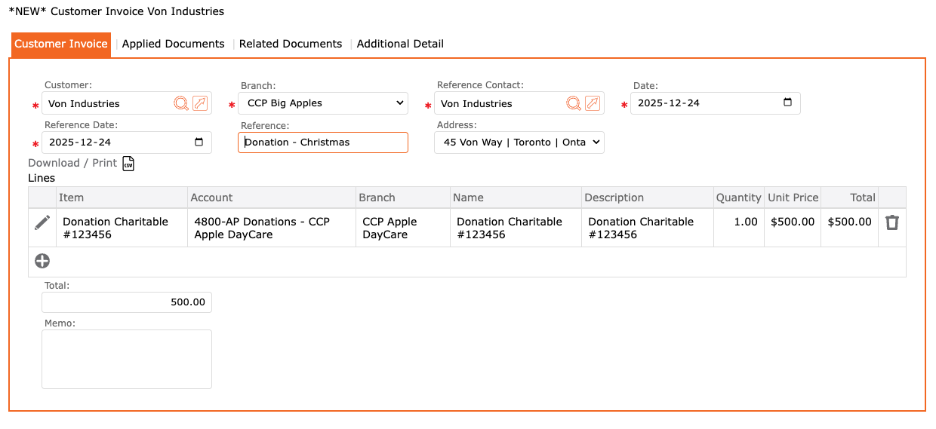

Step 1: Create a manual invoice

- Go to Accounts Receivable > Billing > Manual Invoice

- Customer = Payer

- Branch = Associated Branch to the Payer

- Reference Contact = Payer

- Date = Date received

- Reference Date = Reference Date

- Reference = Note that will display on the statement

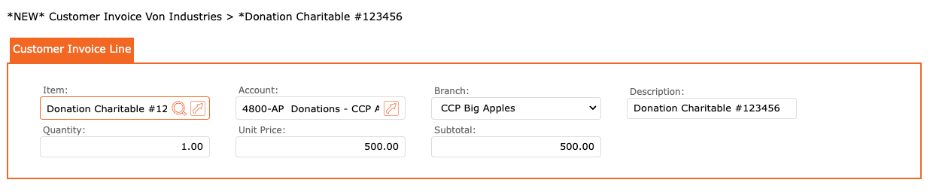

- Lines > Click the “+” icon

- Item = Donation Item

- Account = Associated Account

- Branch = Associated Branch

- Description = Donation’s description (will auto populate once you enter the item)

- Quantity = Can override

- Unit Price = Can override to match the donation amount

- Click the checkmark to apply

- Click the POST icon to complete the manual invoice

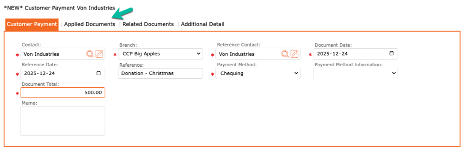

Step 2: Create a Manual Payment received from the payer

- Accounts Receivable > Payments > Manual Payment

- Contact = Payer

- Branch = Associated Branch

- Reference Contact = Payer

- Document Date = Date payment received

- Reference Date = Reference Date

- Reference = Note that will display on statement

- Payment Method = select

- Document Total = Total funds received

- Memo = internal note

- NEXT, you MUST apply the payment to the manual invoice that was created for this donation.

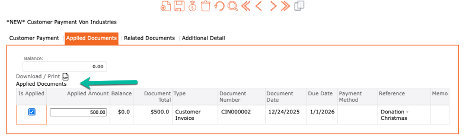

- In the manual payment, click on the tab “Applied Documents”

- Select the invoice that applies,

- Review

- Click POST to complete the process.

IMPORTANT: If you do not apply the payment in the applied documents tab, you will not be able to create a Donation Receipt.

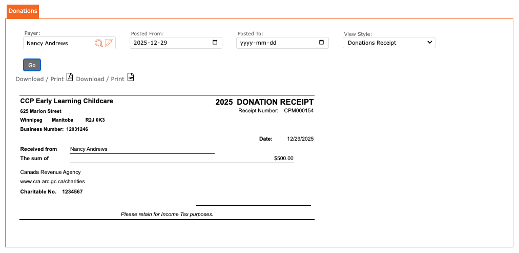

Step 3: Process the Donation Receipt

- Go to Reports > Accounting > Receipting > Donations

- Enter the Name of the Payer

- Enter the Posted from Date (optional)Enter the Posted to Date (optional)

- Select the view style = Donations Receipt

- Click GO

- To print:

- Click the “Download/ Print PDF” icon

- To save to device:

- Click the “Download/ Print PDF” icon

- Save as PDF

- Click the “Download/ Print PDF” icon