If fees were allocated to the parent (payer) and not the child:

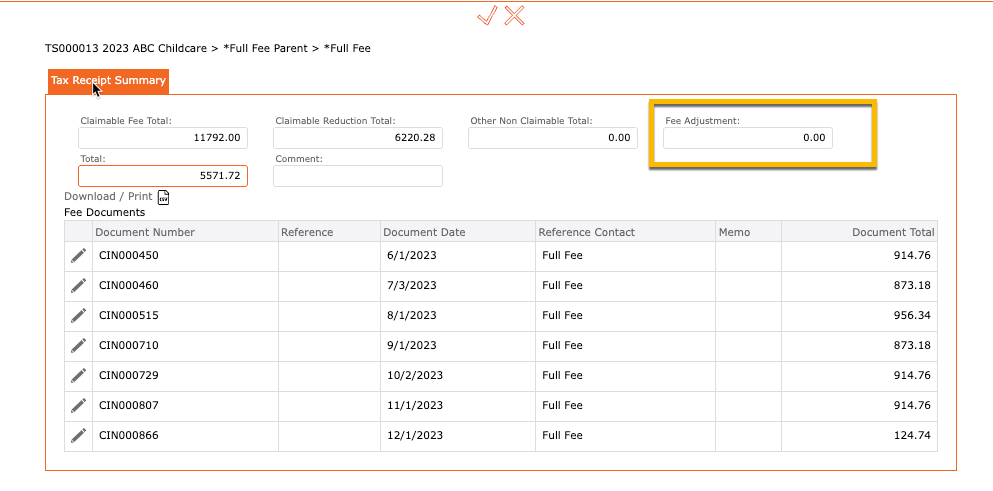

- Edit the charge to the parent (fee adjustment (minus))

- Then, under the Child, make a positive fee adjustment.

- Save

How to proceed:

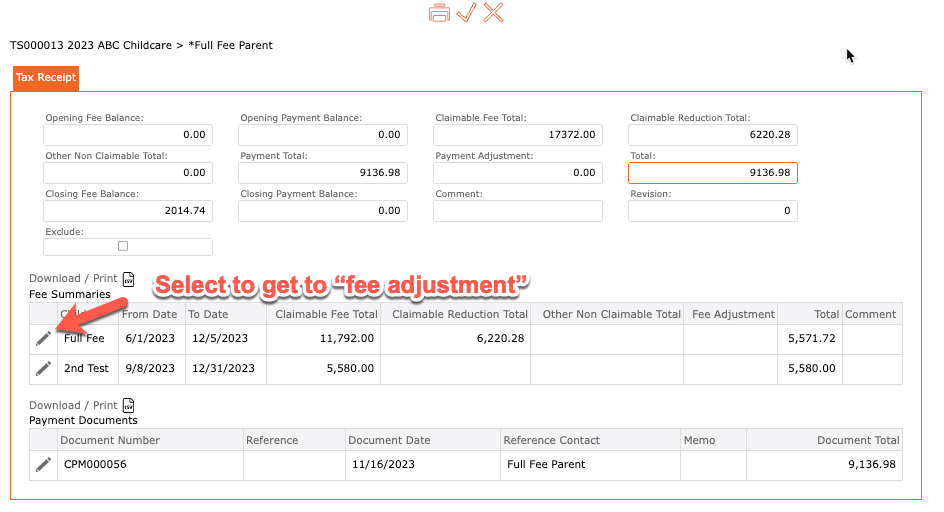

- Go to Accounts Receivable

- Select Tax Receipts

- Select Tax Receipt Batch

- Select the Batch

- Click the edit pencil to the Contact (Tax Receipt) you wish to adjust

- Click the edit pencil to the Fee Summaries you wish to adjust

- Make adjustments

- Click check mark to apply

- Click the SAVE icon to save all adjustments