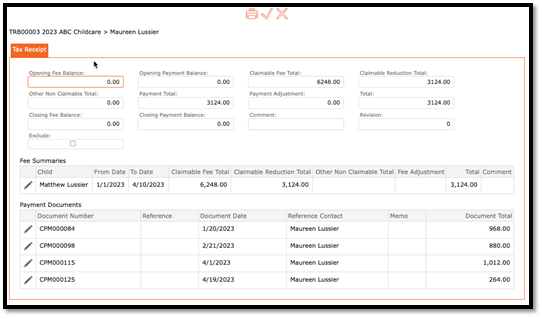

Tax Receipt Page breakdown:

Click on the edit pencil to the left of the Tax Receipt Batch/ Column “Number”.

Tax Receipt Page Breakdown:

- Number: Income Tax Receipt Number

- Opening Fee Balance: Fee balance that is carried over from the previous tax year.

- Opening Payment Balance: Payment balance that is carried over from the previous tax year.

- Claimable Fee Total: Total fees that can be claimed.

- Claimable Reduction Total: Fees that reduced childcare costs (example: subsidy, grants) for the current tax year.

- Other Non-Claimable Total: Fees that cannot be claimed (example: NSF charges, snack fees, etc.)

- Payment Total: Total Payments Received

- Payment Adjustment: Adjustments for payments missed, not previously recorded.

- Total: Total amount displayed on tax receipt.

- Closing Fee Balance: Fee balance as of Dec 31 current tax year.

- Closing Payment Balance: Payments balance as of Dec 31 of current tax year.